Bad Credit Car Loans in Kitchener Ontario

So, you've got some bad credit issues and are thinking of financing a car loan. Don't worry! It's possible, and here are some tips to help you get approved for a bad credit car loan in Kitchener Ontario:

First things first, let's define bad credit. It's usually when you have a history of missed payments, loan defaults, or high credit utilization. This puts you in the high-risk category, but don't let that discourage you. You can still get an Kitchener car loan with bad credit. To boost your chances of approval, follow these steps:

Jump To:

- Know Your Credit Score

- Save for a Down Payment

- Get Pre-Approved

- Find a Co-Signer

- Shop Around for Rates

1. Know Your Credit Score

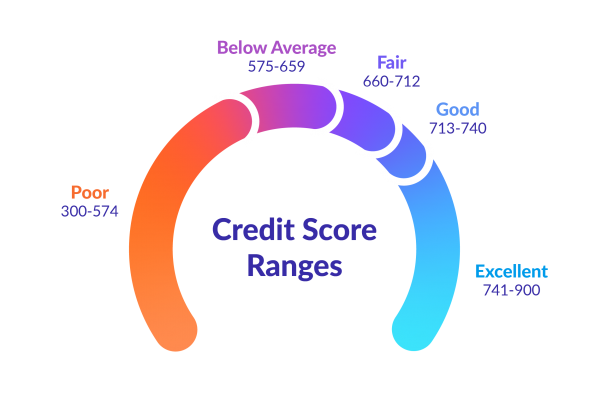

It's essential to check your credit score before you try to finance a car. Sites like Credit Karma or Borrowell offer free credit score checks. This gives you an idea of what interest rates to expect and where you stand.

There are plenty of reasons why knowing your credit score is generally step 1 when it comes to financing a car (or any large purchase for that matter), and we'll briefly walk you through them!

Understand Your Financial Health

Checking your credit score allows you to assess your financial health. Your credit score is a numerical representation of your creditworthiness, based on your credit history.

This information gives you a comprehensive view of how lenders perceive your ability to manage credit and repay loans.

Get an Idea of Your Interest Rate

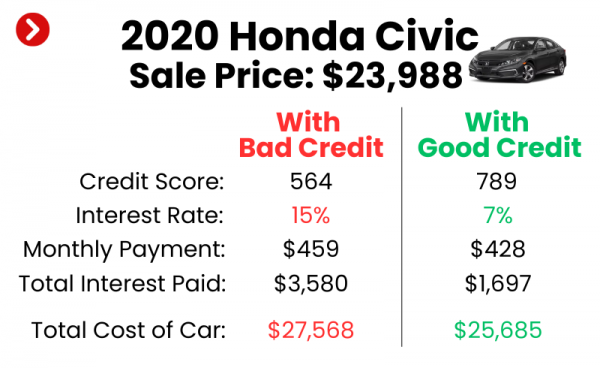

Your credit score significantly influences the interest rate you'll be offered when financing a car with bad credit in Kitchener. Generally, individuals with higher credit scores are eligible for lower interest rates, potentially saving thousands of dollars over the life of the loan.

By knowing your credit score in advance, you can estimate the interest rates you're likely to qualify for, helping you budget appropriately and choose financing options that align with your financial goals.

Identify Errors that are Harmful to Your Credit

Checking your credit score regularly enables you to spot any discrepancies or errors in your credit report. If you notice inaccuracies, addressing them promptly is crucial to maintaining a healthy credit profile.

Correcting errors can positively impact your credit score, potentially improving your chances of securing better financing terms.

Set Realistic Expectations

Your credit score not only influences interest rates but also determines whether you qualify for certain financing options. By knowing your credit score in advance, you can set realistic expectations regarding the type of loan you're likely to secure.

This helps you focus on lenders and financing options that align with your credit profile, saving time and reducing the likelihood of facing unnecessary rejections.

2. Save for a Down Payment (if Possible)

While it's not a requirement, it's always a good idea to have a down payment. A down payment is an initial payment upfront when financing a vehicle, which is usually around 10-20% of the vehicles total cost.

Here are the main benefits of having a down payment on a bad credit car loan in Kitchener.

Gives Lenders Confidence

You could think of a down payment as a way to prove your financial stability to lenders. It shows that you have the ability to save and are willing to invest a portion of your own money into the car purchase.

This can boost your creditworthiness in the eyes of lenders, potentially leading to cheaper loan terms when buying a car with bad credit in Kitchener.

Lowering Monthly Payments

One of the biggest advantages of a down payment is its potential to lower your monthly car loan payments. By putting down a large amount upfront, you reduce the total loan amount, which, in turn, leads to more manageable monthly payments!

This can ease your financial burden and provide greater flexibility in your monthly budget.

Increase Your Chances of Approval

While it's possible to secure car bad credit financing without a down payment in Kitchener, having one can increase your chances of loan approval. Lenders may view a down payment as a commitment on your part, reducing their perceived risk.

This can be particularly beneficial if you have a moderate or less-than-perfect credit score, as a down payment may offset some of the associated risk.

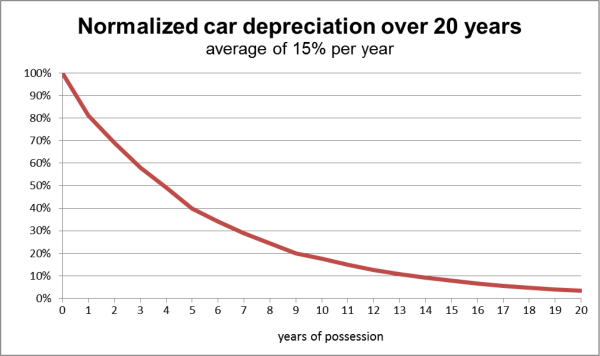

Battles Depreciation

New cars typically depreciate rapidly in the first few years. A down payment can act as a buffer against this depreciation, ensuring that you don't owe more on the car than it's worth.

This protection can be valuable if you decide to sell or trade in the vehicle before the loan is fully paid off.

Do You Always Need a Down Payment?

While saving for a down payment is recommended, some lenders offer $0 down financing options. While this may seem like an attractive option, it's essential to carefully evaluate the terms and conditions.

$0 down financing may come with higher interest rates or longer loan terms, potentially costing you more in the long run. It's crucial to weigh the advantages of immediate affordability against the potential for increased overall costs.

At Northway Ford, we offer $0 down car financing on our bad credit car loans in Kitchener because we understand that while not everyone can afford a down payment right away, sometimes they don't have the time to save up for one and need a vehicle right away. Click here to learn more.

3. Get Pre-Approved

Getting pre-approved for a bad credit car loan in Kitchener can help you determine what you can afford and show lenders you're committed. It's very easy to get pre approved for a vehicle. All you need to do is fill in a car loan pre approval application online, offered by many local financial lenders and local dealerships, like us!

If you're a little foggy on what it actually means, we've written the main benefits below and you can click here to learn more about it!

Understanding Your Budget

Pre-approval provides a clear understanding of the loan amount you're eligible for, helping you establish a realistic budget for your car purchase.

Knowing your financial limitations upfront lets you focus on vehicles within your price range, preventing the disappointment of falling in love with a car that you can't afford.

Need some more help with figuring out a budget? Click here!

Save Time at the Dealership

Getting pre-approved makes buying a car with bad credit in Kitchener so much easier. You'll have a specific loan amount and interest rate, simplifying conversations with dealerships. This can make the entire process more efficient, saving time for both you and the seller.

Also, it pretty much lets you buy a car completely online since that's where you'll be applying most of the time. You can focus more on the vehicle inspection, test drive, and other aspects of the car buying process.

For example, many of our customers buy vehicles from us completely online, and just come to the dealership once to pick it up!

Compare Rates from Multiple Lenders

For individuals with bad credit, getting pre-approved in Kitchener can be particularly advantageous. While the interest rates may still be higher than those offered to individuals with better credit, pre-approval allows you to compare offers from different lenders.

This competition may result in more favorable terms than if you were to rely solely on dealership financing. When we submit applications for our customers, we submit them to multiple banks/lenders and see which one gives us the best rate.

Full Transparency

Pre-approval provides transparency in terms of the interest rate, loan amount, and repayment terms. This eliminates the element of surprise when finalizing the financing at the dealership. You can review and understand the terms in advance, letting you rest easy knowing that there are no hidden fees or unexpected costs.

4. Find a Co-Signer (if Possible)

If you're having trouble getting approved for a bad credit car loan in Kitchener on your own, consider a co-signer. This person agrees to take responsibility for the loan if you can't make payments. Make sure they have good credit and understand the risks!

Here's why they are so beneficial.

Boost Your Chances of Approval

A co-signer, with a strong credit history and financial stability, can significantly enhance your chances of loan approval. Lenders may be more willing to extend credit when there is an additional person responsible for the repayment, especially if your own credit history is less favorable.

Save Money With Cheaper Rates

With a co-signer, you may qualify for better loan terms, including lower interest rates. Lenders love a co-signer with good credit, and in many cases it will result in a more affordable financing arrangement than you could secure on your own.

Building or Rebuilding Credit

Car Loans are already one of the best ways to increase credit score, and for people with bad credit, having a co-signer can help with that even more.

Timely payments on the car loan contribute positively to both your and the co-signer's credit history, potentially opening doors to better financial opportunities in the future.

What are the Risks of Co-Signing?

It's crucial for both you and the co-signer to fully understand the risks involved. If you default on the loan or miss payments, the co-signer is legally responsible for repaying the rest of the loan.

This arrangement requires a high level of trust, communication, and a clear understanding of the potential consequences for both parties.

Choosing a Co-Signer

Selecting a co-signer should be a thoughtful decision. Look for someone who not only has a good credit history but also has a stable financial situation.

A co-signer could be a family member, close friend, or someone with whom you have a trustworthy relationship.

5. Shop around for rates

It's vital to shop around for the best rates when financing a car with bad credit. Don't just accept the first loan offer you receive. Check with different lenders and compare interest rates, loan terms, and fees to find the best deal.

Now that you know how to boost your chances of getting approved for a bad credit car loan in Kitchener, consider filling out our car loan pre-approval form. Here's why:

It's free: Our pre-approval form won't cost you a penny. You can fill it out and get pre-approved for a car loan at no charge.

It's easy: The form is a breeze to fill out and only takes a few minutes. You can do it all from the comfort of your own home.

It's convenient: The form is available online 24/7, so you can apply for a car loan anytime.

If you know your credit situation is tough, head over to Northway Ford. Our team of credit specialists can help you get approved for a car loan today! By the way, we don't just sell Fords! We have hundreds of used cars of all makes and models.