Car Depreciation in Canada: Everything You Need to Know

Car Depreciation in Canada: Everything You Need to Know

Posted on February 6, 2024

Depreciation is where a car loses value over time. It happens to all cars but at different rates depending on the desirability, cost, perceived brand value and current market but is usually at a fairly predictable pace. So how does this factor into a car loan?

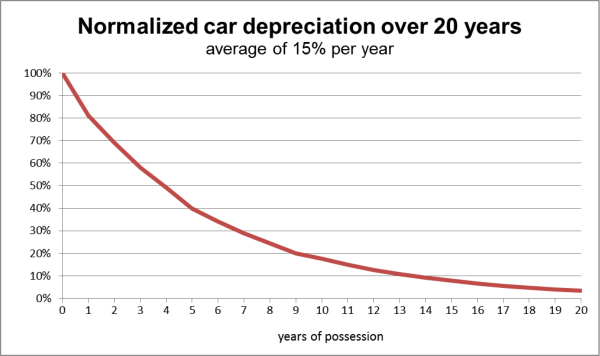

A brand-new car will depreciate between 40-50% within the first five years of ownership. Part of the car loan calculation will be the current value versus the end value when the loan is fully paid off. The lender wants to make sure that if you default, the car will be worth enough for them to make their money back if they need to sell it.

What Causes Depreciation?

As mentioned at the top, there are many factors that cause the depreciation of cars. Some of it is out of your control while you can influence other aspects. Influences include:

- Manufacturer: Some vehicle manufacturers are valued more than others. For example, premium manufacturers such as Lincoln are known for quality which means they can depreciate slower.

- Model & Options: Some vehicle models are more desirable than others. For example, sedans are now worth less than crossovers or SUVs because the market is in favour of those latter vehicle types. Options such as navigation or advanced safety features make a car more desirable, which slows depreciation.

- Year & Mileage: The age of your car when you plan to sell it and the mileage it will have covered factor highly in depreciation. The older the car, the less it is worth. The more miles it has covered, the less it is worth.

- Condition: Vehicle condition affects its resale or trade-in value. This is a factor you can influence. Keep your car in good condition, repair it promptly, repair dings and scratches and look after your car and it could be worth more when it comes to selling.

- Reviews & Ratings: The safety rating and owner reviews can influence how much a car is worth by influencing its desirability. A highly rated car will be worth more than one that didn’t perform so well.

- Safety and Gas Mileage: If your car has a high safety rating it is worth more. If it gets good gas mileage, it is also worth more.

All these things factor into its resale value, which is also taken into account when calculating a loan. If you’re borrowing over 48 months, depreciation would be calculated or averaged for that period. It takes into account how much you will have paid in that time and how much reselling it would be worth during that time.

Your monthly payments would be calculated to stay a little ahead of its value so the lender can always recoup their money should you default.

How to Minimize Car Depreciation

Maintain Records: Your car’s service record and receipts for any work you have done are the only ways a new owner or dealership has to assess its condition. Records show how well, or not, a car has been looked after and whether it requires a service, urgent maintenance or just an oil change.

Every time you have something done on the car, keep receipts to prove it. You may overload the new owner with paper, but it’s always better to have too much than not enough!

Avoid Modifications: The vast majority of car modifications reduce a car’s value to a dealer. They may elevate it for certain parts of the private market or specialist buyers but for a dealership, it means extra work removing those modifications and checking for damage.

Minor modifications like changing the wheels or adding minor window tinting is fine. When it comes to body kits, spoilers, hood scoops and more extreme modifications, you’re limiting its resale potential with everything you bolt on.

Keep Mileage Sensible: If you commute a long way to work or use your truck or car for work, keeping the mileage down may be impossible. In all other situations, minimizing unnecessary journeys can help preserve its value.

Low mileage cars are more valuable as there is usually less wear and tear on the vehicle and it will be longer before more involved maintenance is required to keep the car on the road.

Repair Damage Quickly: Ding or scratch the car so you can see metal underneath. Get it fixed quickly. You can have it touched up by a professional for cheap or buy a touch-up pen for even less.

Never leave bare metal exposed, especially if you live close to the ocean. While most cars now use galvanized steel, which is protected against rust, the longer you leave the damage, the more expensive it becomes.

Rust also spreads.

Choose a Common Colour: Some of the more outlandish car colours can look amazing but they are also niche. You would be surprised at how much influence the colour of a car has on its value and that’s something to bear in mind.

White and silver cars are firm favourites while brighter colours may have less of a market.

Buy a Popular Make & Model: Buying a popular mainstream make and model of cars can go one of two ways. They can be so common that values are kept relatively low and choice is plentiful.

Or, they are common because they are popular and fulfil a definite demand in the market. Parts are cheap for common cars and every garage knows how to fix them.

Thanks for reading! If you're trying to get approved for a car loan in the GTA, we'd love to help with that. Click here to apply today.