What Happens If You Miss a Car Payment & How to Prevent It

What Happens If You Miss a Car Payment & How to Prevent It

Posted on February 10, 2024

Not everything goes as planned. We're humans, and sometimes we make a commitment that we intend to make, but then, life happens.

Often, this happens by no fault of ours. Still, our inability to meet these commitments reflects badly on our image, making us look less than the person of honour we are.

An example of these types of commitment we make is the payment of car loans.

What can you do if you think you'll miss a car payment? Our auto loans team explains.

As you know, failure to meet car payments not only raises the chances of having your repossessed but also affects your credit score. How do you protect your reputation?

What to Do When at Risk of Missing a Car Payment

Speak With Your Lender: Indeed, many car lenders in Canada don't appreciate you failing to make your car payments. Still, you can always get them to listen to reason if you're convincing enough. If you can get your lender to help you extend your payment date to a more convenient time, you've got yourself a great deal as it would not affect your credit score. Of course, this agreement would require you to make additional payments as late fees.

Refinance Your Loan: Sometimes, you find it hard to make a car payment because of the high interest. If your credit score has increased since you've gotten the car, you can request a lower interest on the monthly payment. The only downside to this agreement is that you may pay the loan for a longer time than you initially agreed on.

Sell Your Car: When you know that you may not be able to pay the car anytime soon, it's better to have the car sold to pay off the loan completely. This may be a bold step, but this is a better option than getting your car repossessed and having your credit score drop drastically. Also, if you play your game well, there is a chance you even make a profit. Many people are looking to buy fairly used cars in Canada. You have to determine the car's value and create interesting offers to attract buyers.

Make use of Home Equity: If you have a property of your own, you can have your lender offer equity loans; and pledge in your house as collateral. With this loan, you can borrow a large percentage (up to 80%) of your home's equity to make your car payment.

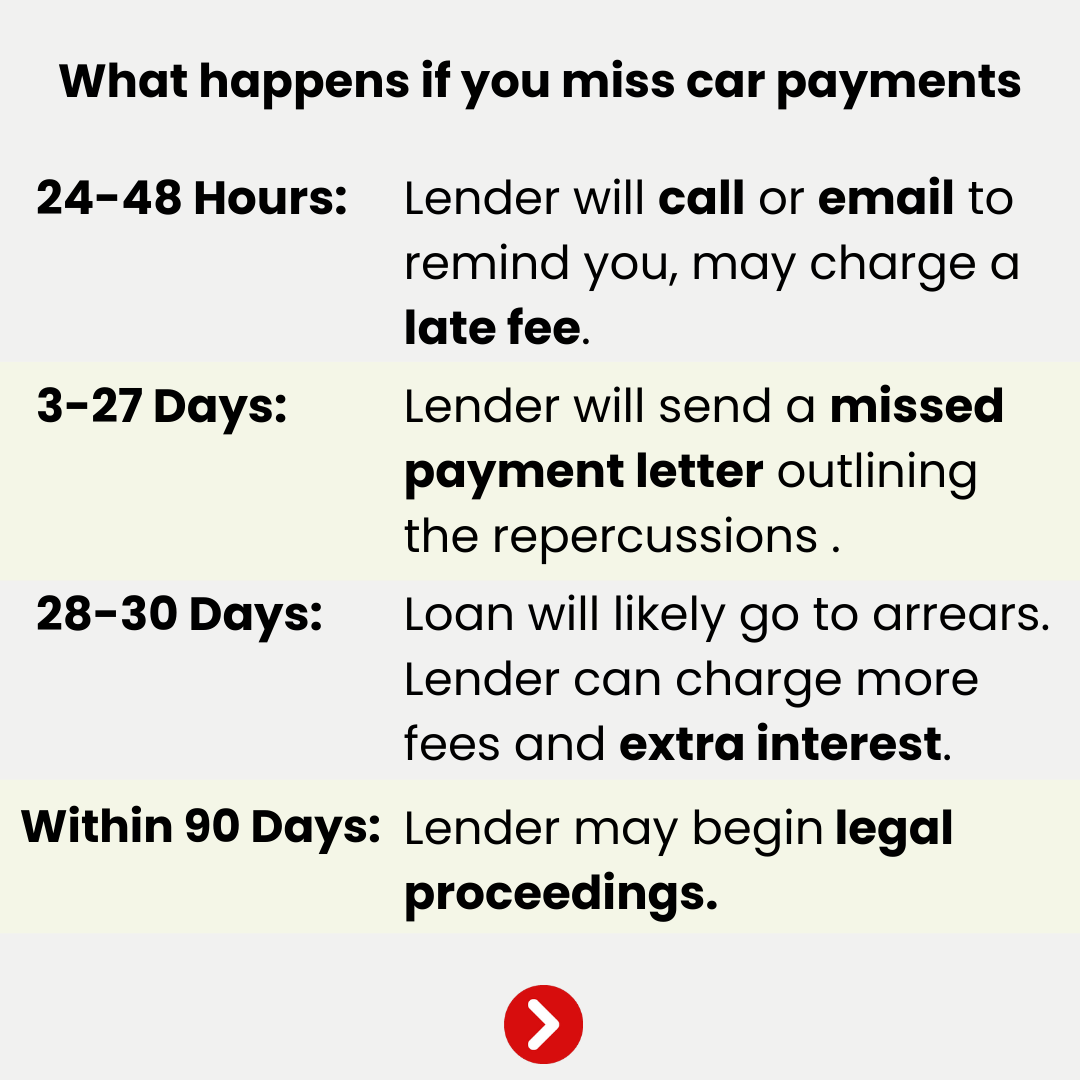

What Happens If You Miss a Car Payment?

In Canada, your auto loan late payment can only affect your credit score after 28-30 days of the due paying date.

After this time, your lender has the right to report you to the credit bureau for a missed car payment.

This missed payment report can reflect in your credit report for up to 6 years, so if you can make the payment before the 30 days elapses, make sure you pay it.

If you need help or advice on anything to do with auto loans, contact Car Nation Canada today, we can help!